Perpetual DEX Development Services

We build decentralized exchanges for perpetual futures contracts that can handle real-world trading pressure. If you’re a Web3 founder looking to launch a high-performance perp DEX, our expertise can help you get there faster without cutting corners on security, liquidity, or user experience.

Our Perp DEX Development Services

Onchain Orderbooks

We build perp DEXes with onchain orderbooks like Hyperliquid, on a dedicated L1 with a built-in trading engine, delivering CEX-like performance without offchain matching, removing latency bottlenecks, and providing full control over risk management.

AMM-Based Perps

At Rock’n’Block, we provide end-to-end AMM perp DEX development, covering contracts, backend, and frontend so your team can launch a fully functional market without juggling multiple teams. We handle everything—from trading logic, risk management, leverage, and liquidations to data streams and providers integrations.

Trading Terminals

Our team develops trading terminals for perp DEXes, integrating APIs and SDKs and managing multiple data streams for fast, reliable interfaces. We also build aggregators that combine liquidity from multiple sources, giving your platform the best execution without handling complex integrations.

GMX Fork

From core logic to data feeds integration and user interfaces, we build perp DEXes using a battle-tested GMX codebase. Our team customizes the fork to your chain stack, tokenomics, and risk strategies, letting you launch faster and reduce development risk compared to building from scratch.

Dashboards

Aggregated dashboards that give users real-time insights across all perp markets, including positions, open orders, PnL, and liquidations. We handle data aggregation, processing, and visualization, providing a clear and reliable interface for traders to track and compare markets.

Data Streaming Infra

We build blockchain data pipelines that deliver real-time and historical data efficiently. With cursor-based streaming, unlimited parallel processing, and smart caching, your platform gets fast, low-latency, and scalable data.

Our Best Works

We helped Blum implement a Firehose/Substreams indexing stack that delivers 10k+ RPS, low-latency streaming, parallel historical processing, and stable reorg handling for their 65M-user multi-chain platform.

Tech Stack:

Go

Rust

See more

SwapX partnered with our team to build a ve(3,3) DEX on Sonic, with AMM and CLMM integrated with ICHI for automated liquidity, a Voting Escrow and rewards system, and over 30 interconnected smart contracts tied together with backend and frontend.

Tech Stack:

Solidity

GraphQL

React

Python

Typescript

See more

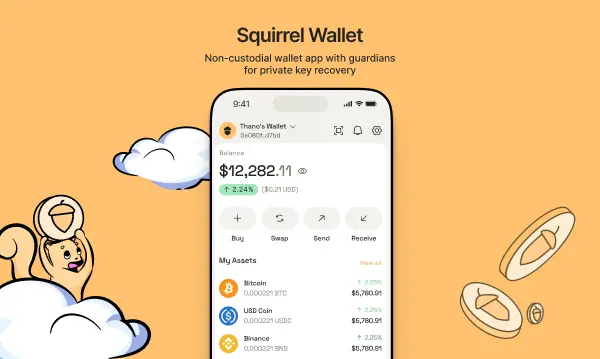

We helped Squirrel Wallet deliver a self-custodial mobile crypto wallet with on-device key management, social recovery via Guardians using sharded secrets, and provider-agnostic rails for swaps and fiat on-ramps

Tech Stack:

Python

PostgresQL

Django

TypeScript

Solidity

React

See more

Delivered a Shibarium liquid staking platform with custom BONE→knBONE staking contracts, an Ethereum↔Shibarium bridge, and full farming and vesting modules

Tech Stack:

React

Redux

Material UI

Python

PostgreSQL

Django

Solidity

See more

Perpetual DEX development features

01

Trading features

Perpetuals

Long & Short Positions

Leverage

Funding Rates

Price Calculation

Liquidation Mechanism

Risk Management

Perpetual Contracts

In perp DEX development, perpetual contracts let traders speculate on assets like crypto, commodities, or indices without an expiry date. Simply put, the contract keeps running until the user closes it. Continuous trading means your platform needs accurate pricing and risk checks all the time.

Long and Short Positions

Perpetuals development includes both long and short positions. Traders can profit when prices move up or down. The challenge is to make sure your matching and margin logic correctly reflects both sides of a trade without introducing inconsistencies.

Leverage Trading

Leverage in decentralised derivatives development amplifies positions using borrowed funds. Simply put, it multiplies exposure, so a small price move has a bigger effect. That means your risk management logic and margin calculations must be airtight.

Funding Rates

Funding rates keep perpetual contract prices close to the underlying spot. In perp DEX development, they prevent big gaps between the contract and market price. This part is mostly about timing, interest calculations, and integrating them cleanly into the trading engine.

Price Calculation

Mark price calculation is at the core of perpetuals development. Simply put, it determines the “official” price to settle trades and trigger liquidations. You need it consistent across contracts to avoid manipulation and unexpected margin calls.

Liquidation Mechanism

Liquidations in decentralised derivatives development automatically close positions that drop below the maintenance margin. Simply put, it stops traders from going negative and keeps the system solvent. The tricky part is making it predictable and fair across multiple positions.

Risk Management Tools

Risk tools—stop-loss, max position size, leverage limits—are part of perp DEX development. They give traders guardrails to manage exposure. From a platform perspective, it’s about coding these constraints into the engine so they interact predictably with margin, funding, and liquidations.

02

Liquidity Management Features

Liquidity Pools

Dynamic Margin Requirements

Liquidity Incentives

Cross-Margin and Isolated Margin

Fees and Rebates

Liquidity Pools

In perp DEX development, liquidity pools provide assets for each perpetual contract. They keep trades flowing smoothly and reduce slippage, ensuring the system can handle high trading volumes reliably.

Dynamic Margin Requirements

Dynamic margins, a core part of perpetuals development, adjust in real time based on volatility and market conditions. This approach protects traders from unexpected liquidations while maintaining platform stability.

Liquidity Incentives

In decentralised derivatives development, incentives encourage users to fund liquidity pools. Rewards help maintain healthy liquidity and active trading without adding unnecessary complexity to the system.

Cross-Margin and Isolated Margin

Perp DEXes support both cross-margin and isolated margin modes. Cross-margin uses balances across contracts for efficiency, while isolated margin separates positions for precise risk control. Offering both gives traders flexibility and predictability.

Fees and Rebates

Fees and rebates in perpetuals development guide trader and liquidity provider behavior. Well-calibrated structures generate revenue while encouraging liquidity provision, keeping trading active and orderly.

03

Risk Management Features

Real-Time Risk Monitoring

Price Index Feeds

Collateral Management

Dynamic Position Limits

Stop Loss/Take Profit Orders

Real-Time Risk Monitoring

Within perpetual DEX development, real-time risk monitoring is essential for maintaining platform stability and safeguarding trader assets. This feature continuously monitors traders' positions and account balances, promptly identifying potential risks such as margin deficiencies or excessive exposure. By leveraging real-time data analytics and risk assessment algorithms, the platform can take necessary actions, including margin calls or liquidations, to mitigate risks and protect traders from significant losses, thereby fostering trust and confidence among users.

Price Index Feeds

Perpetual DEX platforms integrate reliable price index feeds from multiple reputable sources to ensure accurate price discovery and reduce the risk of manipulation. These price index feeds serve as a reference point for determining contract settlement prices and maintaining consistency across the platform. By sourcing data from diverse and trusted sources, the platform enhances transparency, reduces the likelihood of price manipulation, and provides traders with reliable market information, ultimately promoting fair and efficient trading conditions.

Collateral Management

Collateral management is a critical aspect of perpetual DEX development, aimed at efficiently managing trader collateral to minimize the risk of default. This feature ensures that the collateral provided by traders adequately covers their positions and maintains a sufficient margin buffer to withstand market fluctuations. By implementing robust collateral management mechanisms, such as automated margin calls and collateral rebalancing, the platform can effectively mitigate counterparty risk, protect the integrity of the trading ecosystem, and ensure the timely settlement of trades, fostering a secure and resilient trading environment.

Dynamic Position Limits

Perpetual DEX platforms dynamically adjust position limits based on various factors such as account balance, trading volume, and prevailing market conditions. This feature enables the platform to adapt to changing risk profiles and market dynamics, ensuring that traders' exposure remains within manageable levels. By implementing dynamic position limits, the platform promotes responsible trading behavior, prevents excessive risk-taking, and enhances overall risk management effectiveness, thereby safeguarding the interests of traders and maintaining platform stability.

Stop Loss/Take Profit Orders

Stop loss and take profit orders are essential risk management tools offered by perpetual DEX platforms. These orders allow traders to set predefined price levels at which their positions will be automatically liquidated (stop loss) or profit-taking orders executed (take profit). By enabling traders to automate risk management strategies, such as cutting losses or locking in profits, these orders help mitigate downside risks and optimize trading outcomes. Additionally, stop loss and take profit orders enhance trading discipline, reduce emotional decision-making, and improve overall risk-adjusted returns for traders, contributing to a more efficient and sustainable trading ecosystem.

How We Work

Why Choose Rock'n'Block for Perpetual DEX Development

70M+

DeFi Users

Our infrastructure powers products used by over 71 million people globally. We also bring this expertise to perp DEX development, ensuring high-performance markets for millions of traders.

8+

Years in Web3 Development

Building blockchain products since 2017, we bring nearly a decade of experience to every project. Our perp DEX development services leverage this experience to deliver reliable, scalable trading platforms.

$167M

Funds Raised

Our partners and projects have raised $167 million using systems and solutions we built. This includes support for successful perp DEX launches and growth.

$2.5B

Market Cap

We support chains and applications with a combined market cap of $2.5 billion. Our perp DEX development work contributes to robust, high-value ecosystems.

%201.webp)